Nairobi, Kenya – The Central Bank of Kenya (CBK) maintains and regularly updates a public directory of all licensed Digital Credit Providers (DCPs) in a move to enhance transparency and consumer protection within the rapidly growing digital lending sector. This directory serves as a crucial resource for consumers, researchers, and publications seeking to verify the legitimacy of digital lenders and conduct in-depth analysis of the market.

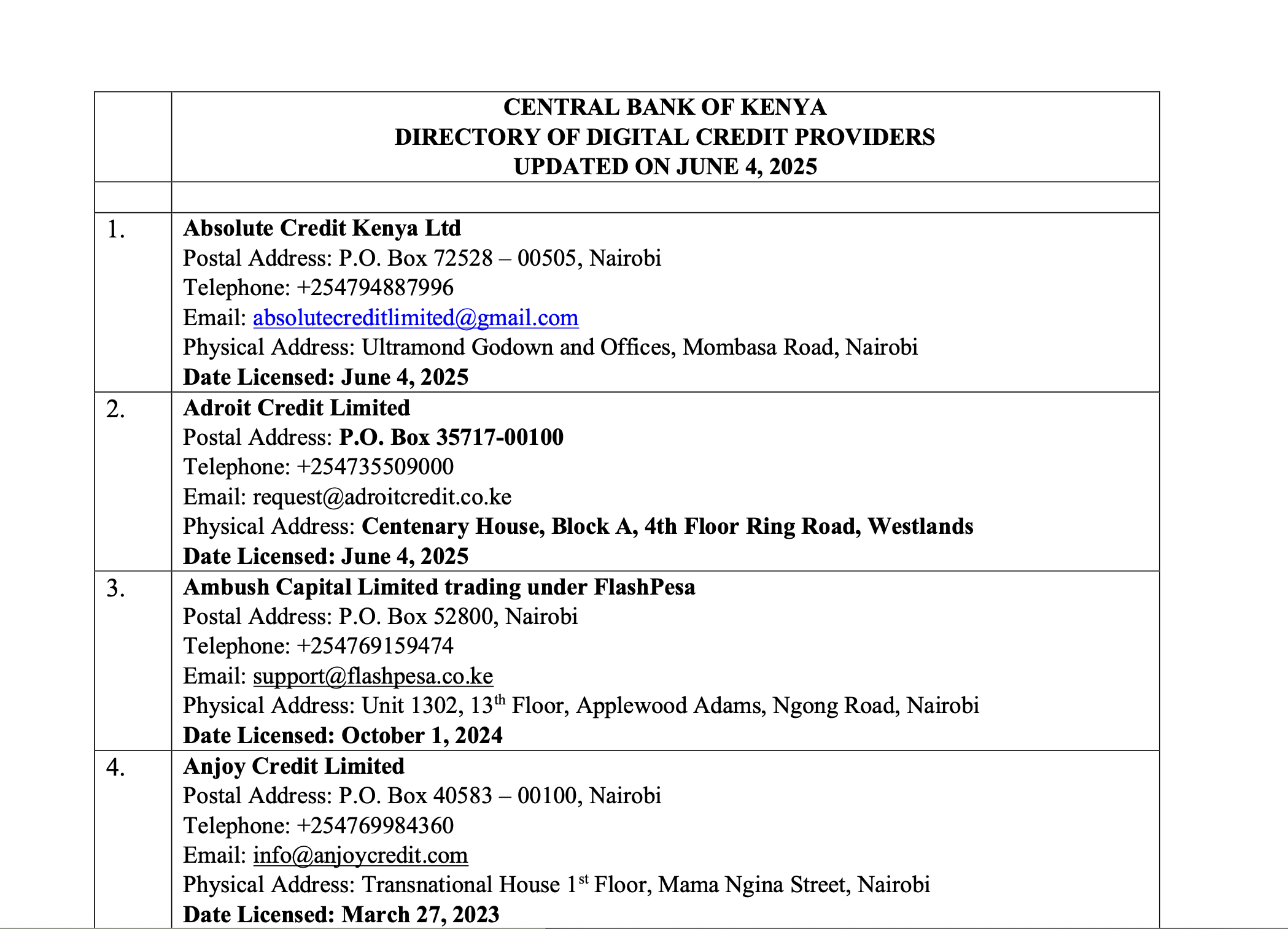

The most recent version of the “Directory of Digital Credit Providers”, updated as of June 4, 2025, is readily accessible on the Central Bank of Kenya’s official website. This document provides a comprehensive list of all entities licensed to offer digital credit products in Kenya, ensuring they operate within the regulatory framework established by the Central Bank of Kenya (CBK).

The directory includes key details for each licensed provider, such as their registered name and contact information, offering a reliable point of reference for the public. The establishment of this directory is part of the CBK’s broader mandate to supervise the digital lending space, a measure that was institutionalised through the Central Bank of Kenya (Amendment) Act, 2021, and the subsequent Central Bank of Kenya (Digital Credit Providers) Regulations, 2022.

These regulations were introduced to address public concerns regarding predatory lending practices, including exorbitant interest rates, unethical debt collection methods, and the misuse of personal data. By making the directory publicly available, the CBK empowers consumers to make informed decisions and avoid unlicensed and unregulated lenders.

For those seeking a “deep search” or more extensive publications on the topic, the Central Bank of Kenya’s website is a primary source. The “Publications” and “Press Releases” sections of the website offer a wealth of information, including:

- The Central Bank of Kenya (Digital Credit Providers) Regulations: The full legal text outlining the licensing requirements, governance standards, and consumer protection principles that all digital lenders must adhere to.

- Press Releases: Official announcements from the CBK regarding the licensing of new DCPs, updates to the regulatory framework, and any enforcement actions taken against non-compliant entities.

- Circulars and Notices: Guidance and directives issued to the banking and financial sector, which may include specific instructions for digital credit providers.

Researchers and journalists can utilise these official documents to gain a thorough understanding of the evolution of digital lending in Kenya, the regulatory landscape, and the Central Bank’s ongoing efforts to foster a fair and responsible credit market.

The public is strongly advised to transact only with licensed digital credit providers as listed in the official CBK directory to safeguard their financial well-being and personal data.