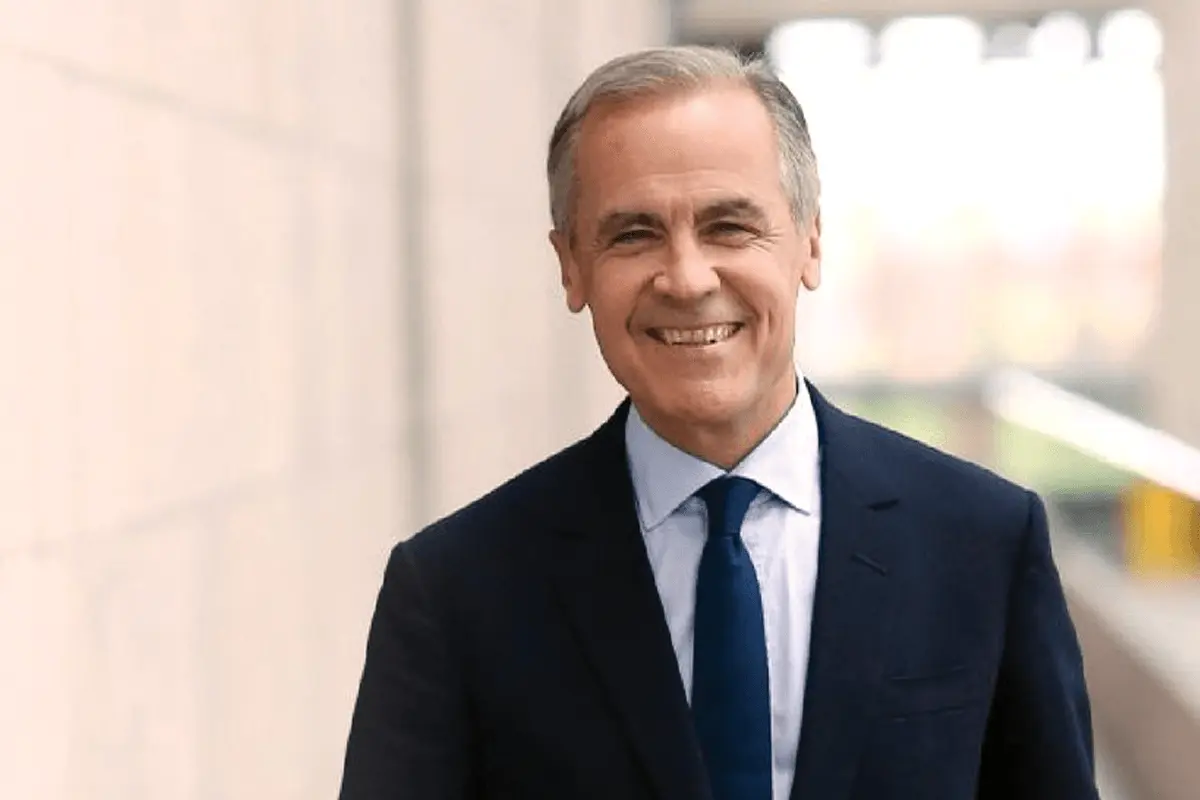

Mark Carney’s ascent to the role of Canada’s 24th Prime Minister heralds a transformative moment in global leadership. Renowned as a former governor of the Bank of Canada (2008–2013) and the Bank of England (2013–2020), Carney brings a rare blend of pragmatic economic expertise, global financial acumen, and a steadfast commitment to climate action. His appointment signals a potential recalibration of Canada’s foreign policy, trade dynamics, and development strategies—offering African nations a chance to deepen their partnership with one of the world’s most stable and resource-rich economies.

For Africa, a continent navigating rapid demographic growth, economic diversification, and climate challenges, Carney’s leadership could usher in a new era of collaboration. Below, we explore the implications of his tenure for Canada-Africa relations across key domains.

A New Chapter in Canada-Africa Relations

Canada’s engagement with Africa has long been rooted in diplomacy, development aid, and economic ties, particularly in mining, education, and energy. Under Carney, this relationship could evolve into a more strategic, mutually beneficial partnership emphasizing sustainability, economic resilience, and innovation. His global stature and forward-thinking approach position Canada to play a pivotal role in Africa’s development trajectory.

1. Stronger Economic and Trade Partnerships

Carney’s extensive experience in global finance suggests a shift toward deeper economic integration with African markets. The African Continental Free Trade Area (AfCFTA), launched in 2019 and gaining momentum by 2025, aims to unify 1.3 billion people and over $3 trillion in GDP into the world’s largest free trade zone. Canada, under Carney, could seize this opportunity to expand its economic footprint in Africa. Key areas of focus might include:

- Green Energy and Sustainable Mining: Canada is a dominant player in Africa’s mining sector, with companies like Barrick Gold and Ivanhoe Mines leading investments in gold, copper, and rare earth minerals. Carney’s climate-conscious leadership could steer these firms toward greener practices—such as adopting low-emission technologies or rehabilitating mining sites—while increasing investments in renewable energy projects like solar and wind farms.

- Agribusiness and Food Security: Africa’s agricultural potential remains vast but underutilized. Canada, with its expertise in agribusiness and cold-chain logistics, could bolster food security by supporting precision farming technologies, irrigation systems, and supply chain infrastructure. Partnerships with African nations like Kenya or Nigeria could enhance export markets for both sides.

- Trade Diversification: Beyond commodities, Carney might encourage Canadian firms to explore Africa’s burgeoning consumer markets, particularly in tech, manufacturing, and services, fostering a more balanced trade relationship.

2. Climate Finance and Green Development

As the former UN Special Envoy for Climate Action and Finance (2020–2023), Carney has been a global advocate for mobilizing capital to combat climate change. His leadership could position Canada as a key partner in Africa’s green transition, where climate vulnerabilities—like droughts in the Sahel or rising sea levels in coastal cities—demand urgent action. Potential initiatives include:

- Increased Climate Funding: Canada could scale up contributions to multilateral funds like the Green Climate Fund or establish bilateral programs to finance renewable energy grids, reforestation efforts, and climate-resilient infrastructure in African nations.

- Carbon Markets and Conservation: Carney’s promotion of carbon pricing and offset markets could benefit African countries with vast forests, such as the Democratic Republic of Congo. By integrating these nations into global carbon credit systems, Canada could help them monetize conservation efforts while advancing its own net-zero goals.

- Private Sector Mobilization: Leveraging his private-sector ties (e.g., his role at Brookfield Asset Management), Carney might encourage Canadian firms to invest in Africa’s clean energy startups or green bonds, amplifying the continent’s access to capital.

3. Revamping Canada’s Development Assistance

Canada has historically provided significant aid to Africa through agencies like Global Affairs Canada, focusing on health, education, and governance. Carney’s finance-driven mindset could modernize this approach, shifting from traditional aid to a model that catalyzes private investment. This might involve:

- Blended Finance Models: By combining public funds with private capital, Canada could de-risk investments in African infrastructure—think ports, railways, or digital networks—making them more attractive to global investors.

- Impact Investing: Carney might prioritize funding for African enterprises that align with social and environmental goals, such as women-led businesses or renewable energy cooperatives, amplifying Canada’s developmental impact.

- Capacity Building: Enhanced support for African financial institutions and regulators could strengthen local economies, reflecting Carney’s belief in systemic resilience.

4. Geopolitical and Security Considerations

In an era of rising global tensions—exacerbated by conflicts in Ukraine, the Middle East, and beyond—Africa’s stability is increasingly critical. Canada has a legacy of UN peacekeeping in Africa, notably in Mali and Rwanda. While Carney is unlikely to prioritize military engagement, his administration could:

- Use Economic Stability as Peacebuilding: By fostering job creation and economic growth in fragile states like Somalia or South Sudan, Canada could address root causes of conflict indirectly.

- Deepen Diplomatic Ties: Strengthened engagement with the African Union (AU) and regional bodies like ECOWAS or SADC could enhance Canada’s influence in multilateral forums, aligning with Carney’s diplomatic finesse.

5. Empowering Africa’s Youth and Innovation Ecosystem

Africa’s youth population—projected to reach 2.5 billion people under 25 by 2050—represents both a challenge and an opportunity. Carney, attuned to global innovation trends, could champion initiatives to harness this demographic dividend:

- Educational Partnerships: Expanding programs like the Canada-Africa Research Exchange or scholarships for African students could build long-term intellectual bridges.

- Startup Support: Canada could launch innovation funds or incubators targeting African tech hubs in Lagos, Nairobi, or Cape Town, fostering solutions in fintech, health tech, and agritech.

- Digital Connectivity: Investments in broadband infrastructure could accelerate Africa’s digital economy, aligning with Carney’s vision of inclusive growth.

Conclusion: A Strategic Opportunity for Africa

Mark Carney’s leadership as Canada’s Prime Minister allows Africa to forge a more dynamic partnership with a G7 nation. His expertise in finance, commitment to sustainability, and strategic foresight could elevate Canada-Africa relations beyond traditional aid into a realm of investment-led growth, climate collaboration, and innovation. From bolstering trade under AfCFTA to financing green development, Carney’s policies could leave a lasting imprint on the continent.

Yet, the success of this partnership hinges on proactive engagement from African leaders. Governments and businesses must position themselves to attract Canadian investment, align with Carney’s climate goals, and leverage his administration’s focus on resilience. If Africa seizes this moment, it could unlock enduring economic and environmental benefits, redefining its relationship with Canada for decades.